Virtual but personal

We are a team of Chartered Certified Accountants with over a decade’s experience helping businesses reach their full potential.

On the 1st October 2023, Steele Financial Limited merged with Streets Chartered Accountants, the new combined firm is known as Streets Steele. Streets is a well-established top 40 UK practice with offices across the Midlands, London, South East England, Yorkshire, the East of England and London.

As part of the wider Streets practice Street Steele is able to draw on specialist services including financial planning, corporate and personal tax advice, banking & finance and international compliance and advisory work.

Specialising in cloud accounting

Experienced team

Full range of services

At Streets Steele we help companies from all industries thrive. We cover everything from bookkeeping & VAT to higher management-level business advice and reporting, ensuring that each of our clients reaches their full potential.

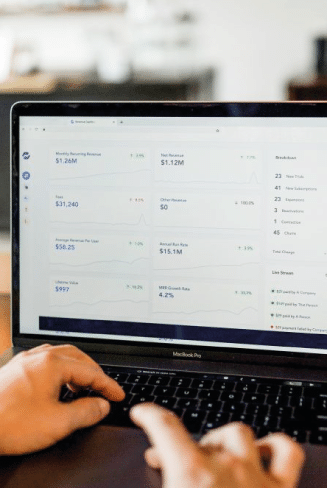

Cloud accounting

Meet the in-house team

We also have a range of outsourced expertise to ensure you always received the best and most technically sound advice, no matter what.

The experience of the Streets Steele team covers a range of areas, including bookkeeping and admin systems, VAT, corporate tax, personal tax, business advice and fintech.

We are passionate about cloud accounting and using financial technology to improve businesses and make them more profitable.

Paul Tutin

Ben

Ryan Saward

Stacey

Damon

Sally

Hollie

Jed Hughes

David

Helen

Lucy

Michael

Ryan Steele

Guilherme

Leila

Aaron

Tom

Lynne Saward

Jadine

Honey

FAQs

We are here to help you with any questions you may have

Absolutely! Whether you are already on Xero when you come to us, or you would like to move to Xero, we ensure the switch is smooth and pain free, including back-ups of historical data to access when needed.

Excel definitely still has a time and place, however, for the main bookkeeping and records, Xero is the one.

All of our clients will need to be using Xero. Sometimes it is possible for clients to send us certain data on Excel, which we can then import in to Xero.

If in the previous 12 months your turnover has reached the VAT threshold amount of £85,000 (As of April 2013) or you expect your turnover to reach £85,000 in the next 30 days then it is mandatory that you must register for VAT.

If you are under the VAT threshold amount of £85,000 then you do not have to charge VAT on your goods and services. The threshold amount can change so make sure to check the HMRC website each year to ensure you are not over or under this amount.

The team you see above is our full-time in-house team. We also have various outsourced experts in a wide range of areas to call upon whenever they are needed, including IFAs, VAT experts, Tax specialists etc.

If one of our team hasn’t spoken with you at least twice in the year (minimum) then we aren’t happy. Our basic promise is a guaranteed 24 hour response to you.

We then also encourage regular contact throughout the year, to make sure you and your business are on track, and that we can prepare you for tax bills ahead of time, enabling us to discuss how to reduce that upcoming bill.

Because a lack of financial planning is one of the main reasons a business fails.

Well thought out budgets and forecasts become an indispensable tool for your business both to evaluate if there are going to be any challenges ahead and to give guidance regarding how much money you should be spending. You can then monitor your actual spend against your budget, to help evaluate how your business is doing and to help guide you to achieve your goals.

Use us to give you peace of mind that you will not receive a poor budget or forecast which as well as being useless, could also become misleading and encourage you to make poor decisions that cost you money.

Budgets & forecasts are also essential if you ever plan to raise funding, approach investors, or have plans to expand.

As part of our Payroll service, we provide each of these services as standard:

- Electronic payslips with an employer payroll dashboard

- Payroll reports (including departmental analysis)

- Pension auto enrolment

- HMRC electronic filing (RTI)

- BACS/Telepay submission report

- Holiday pay

- Year end reports

These are some of the things that Xero allows you to do:

- Create invoices and purchase orders

- Bank feeds to reconcile transactions

- Create expense claims which can be approved and paid

- Scan receipts using the Xero Mobile app

- View your accounts with a variety of different reports

- Asset Register

- Dashboard to monitor business performance